Table of Contents

All that Business Owners Need to Know about Insurance.

Different people usually hold different views about the insurance policy. In the west, most people prefer buying such plans that help them once they are grown up. People that retire from the private sector prefer buying such plans that last lifelong or at least as long as they want.

Well, in my opinion too, buying a smart life insurance policy is always a great idea if you have loved ones and their lives may get affected by your departure. This is probably the best possible thing that you can do for them. Now the thing is that almost all saner people would prefer buying protection, but what matters the most is whether they have bought the right one or not.

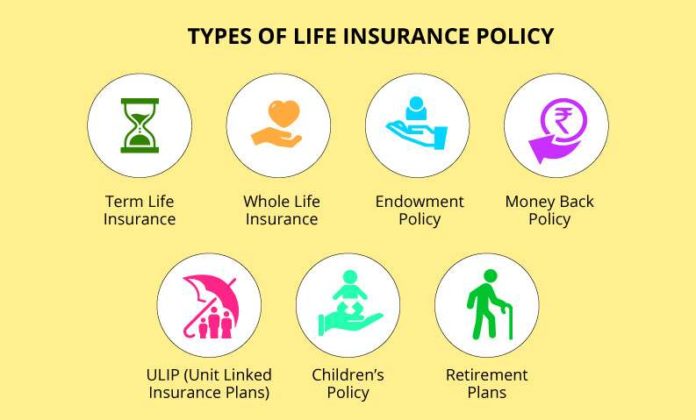

Insurance policies are always designed and planned in such a manner that they come with various hidden factors. Plus, the calculations and math aren’t that simple for a layman to easily absorb. So the trickiest part is choosing the one that suits you the most. Here in this article, we are going to talk about some of the very fundamental and basic types of life insurance policies that are more or less prevalent in all countries with somehow just some minor alterations.

The very basic two types of life insurance are

Term Insurance

As the names show that the term insurance is meant for some specific terms, it may come with various offers different premium plans and plenty of options to choose from. This is meant and designed for a specific period of time, for instance, this might be planned for 10, 20 or 30 years.

The term insurance policies are extremely cheap as compared to the permanent ones. In most of the plans, your premium amount is expected to remain the same throughout the entire term. Term insurance is better in cases when someone is certain about a certain future time period when his responsibilities would be reduced like his/his kids would have grown up.

Permanent Insurance

In such cases term remains a very convenient and promising option. In most ideal scenarios where you are a non-smoker and hold a very good health portfolio aged around 300, you may buy a term for around 20 bucks, just as cheap as this may get.

As far as permanent insurance is concerned, just like its name, it is meant for your entire life. This is a cover for the rest of your life and it would cover you till your last breath. There are various types of subtypes of permanent insurance again, yet the most common ones are

Whole Life Insurance

In the permanent insurance, this is pretty obvious that your family is going to get the benefits of the policy once you die only if you regularly keep paying the insurance premium until your last breath.

Universal Life Insurance

The universal life insurance is different in a manner that if offers a kind of built-in flexibility that makes it much easier for you to keep going with the premium and the policy. Here you have the freedom to make changes in your premium plan and also in your death benefits keeping in view your changing life circumstances.

This option certainly enables you to tailor a more favorable insurance policy plan for yourself that you feel perfect for yourself. This is probably the elitist type of insurance policy as this offers diverse guaranteed benefits that are accessible at any given time. This gives you more liberty to set limits of how much you can pay and hence set the benefits with the same proportion.

No matter what happens with the economy or even the company, the cash values are supposed to grow at the same pace. Always do a lot of research before buying a policy plan as this is a matter of life and not just a few months or years.